Property Taxes and Exemptions in the Texas Hill Country Explained

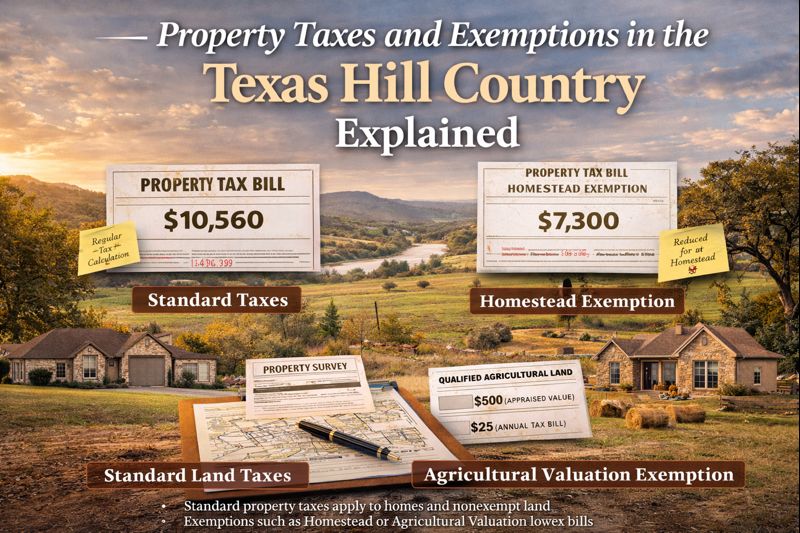

Property taxes in the Texas Hill Country can vary widely based on county, school district, exemptions, and land use classification. Two similar-looking properties can have very different tax burdens depending on whether they qualify for exemptions such as homestead or agricultural valuation.

Relocation buyers often focus on Texas having no state income tax and underestimate how local property taxes impact long-term affordability. Land buyers may also misunderstand how agricultural exemptions work or assume they transfer automatically, which is not always the case.

A Texas Hill Country Realtor evaluates property taxes as part of the purchase decision, not as an afterthought. Understanding how taxes affect carrying costs and resale is essential, especially for buyers planning long-term ownership or retirement.

For a higher-level view of how taxes fit into Hill Country real estate decisions, see the main Texas Hill Country Realtor overview page.

https://chrispesek.com/blog/what-is-a-texas-hill-country-realtor