Cost of living and housing affordability in Austin and Central Texas

Last updated: January 29, 2026

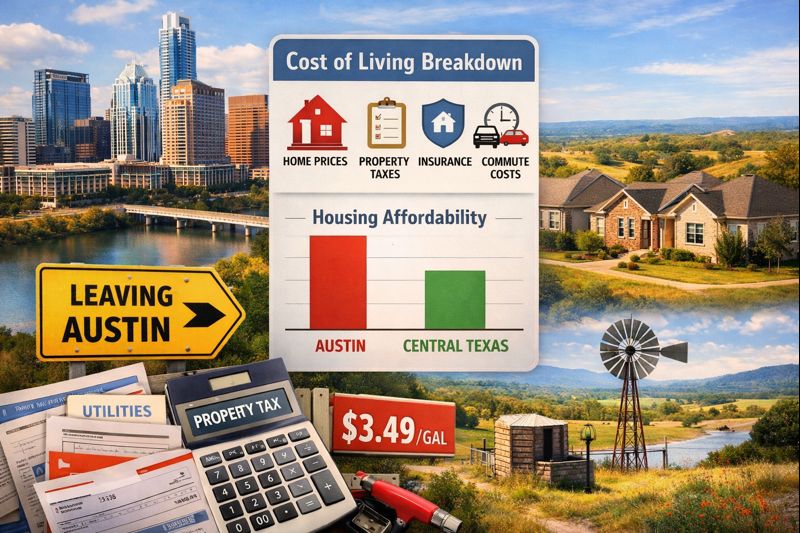

Austin’s cost of living has risen faster than incomes, and housing affordability has become the main pressure point pushing people to move out of the city and into surrounding parts of Central Texas. While prices have cooled from peak levels, taxes, insurance, and daily expenses still make long-term affordability inside Austin difficult for many households.

Austin is no longer an affordable housing market for most middle-income buyers without trade-offs. Central Texas outside the city core offers lower purchase prices and more flexibility, but costs vary widely by location, tax structure, and infrastructure.

Housing affordability here is driven less by home price alone and more by the full ownership stack. Property taxes, insurance costs, utility access, and commute trade-offs all matter. Income growth has not kept pace with housing costs, especially for buyers entering the market for the first time or downsizing on fixed incomes.

Supply constraints inside the city, combined with sustained population growth, keep pressure on prices even when sales slow. Outside Austin, affordability improves, but only if buyers understand how tax rates, MUDs, and service districts affect monthly costs.

Many buyers focus on list price and ignore the effective tax rate, which can double the monthly payment difference between two similar homes. Others assume moving 20 to 30 miles out automatically means cheaper living, which is not always true once fuel, time, and infrastructure costs are added.

Another common mistake is assuming Central Texas is a single market. It is not. Each county, school district, and utility provider changes the math.

Within the city of Austin, homeowners often face high property taxes paired with rising insurance premiums and limited lot sizes. This pushes move-up buyers and retirees to look outward.

In surrounding areas, buyers may find lower home prices but higher tax rates due to MUDs or newer developments. Rural properties can reduce purchase cost but introduce expenses for wells, septic systems, and longer service response times. Affordability improves only when these factors are planned for upfront.

If you plan to stay inside Austin, affordability depends on accepting smaller homes, older construction, or higher monthly costs. For many households, that trade-off no longer makes sense long term.

Moving into Central Texas can improve affordability, but only with careful location selection. The best outcomes come from balancing tax structure, infrastructure, and lifestyle needs rather than chasing the lowest price per square foot.

Property tax rates can be confirmed through county appraisal districts and the Texas Comptroller. Insurance trends are best verified with local carriers who underwrite Central Texas properties. Population and housing data can be reviewed through local planning departments and regional councils.

For market trends, cross-check sales data with MLS reports and local housing authorities. Flood and environmental risks should be verified using FEMA Flood Maps and county records.

Austin’s affordability problem is structural, not temporary. Central Texas offers alternatives, but the savings are real only when buyers understand taxes, infrastructure, and long-term ownership costs before moving.

If you want a risk-first read on a property or piece of land before you commit, reach out and we’ll map the red flags early.

You can find more resources at https://chrispesek.com, email chris@drippingspringshometeam.com, or call 512-736-1703. Chris Pesek is a Texas Hill Country Realtor specializing in land, acreage, and custom homes. 383+ sales. Top 2 Percent Producer. 63 five-star reviews.